tax sheltered annuity taxation

Ad Learn More about How Annuities Work from Fidelity. In this publication you will find information to help you do the.

Annuity Contributions Tax Deductible Or Not 2022

This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan.

. Get started and take the 3-Minute Confident Retirement check to start finding answers. Ad Get this must-read guide if you are considering investing in annuities. A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts.

Ad Learn More about How Annuities Work from Fidelity. However the downside of doing so is that for an annuity held outside an IRA the entire amount of the appreciation between. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary.

Take a Closer Look at the Main Types of Annuities Common FAQs. Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed and therefore the contributions and. You can also choose Roth after-tax contributions or a.

Of course this is assuming you have a pre-tax annuity. What is a Tax-Sheltered Annuity. Learn some startling facts.

A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. Can a tax-sheltered annuity be rolled into an IRA. The terms tax-sheltered annuity and 403b are often used interchangeably.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. Ad Our 3-Minute Confident Retirement check can help you start finding the answers. Such assets referred to as non-probate assets include.

When an annuity payment is made 50 of each payment would be income taxable. Specifically whether a tax-sheltered annuity can be. Read the Other Advantages an Annuity Provides How You Can Benefit from One Today.

For instance if the premiums to pay for an annuity came from a tax-deferred retirement. A qualified annuity is one you purchased with money on which you did not pay taxes. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 penalty on the taxable portion of the withdrawal. Rolling Over an Annuity to an IRA Several employer retirement plans come in the form of a variable annuity contract such as a 457 or 403b plan especially in the public sector. Ad Curious About Annuities.

If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. After that age taking your withdrawal as a.

An annuity thats considered tax-sheltered is a way for employees of tax-exempt organizations and the self-employed to generate retirement. The original annuity contract dictates how payment streams are taxed. See reviews photos directions phone numbers and more for Tax Deferred Annuity locations in Los Angeles CA.

The employee will not pay any taxes on their. Assets that have a designated beneficiary listed on the account are allowed to transfer ownership outside of probate. Kaiser Permanente Tax Sheltered Annuity Plan This plan helps you build retirement savings while lowering your current taxable income.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue. The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. The simplest is to elect an immediate lump sum.

Annuities are often complex retirement investment products. Ad Compare Multiple Annuities Each With Their Own Tax Benefits.

Annuity Taxation How Various Annuities Are Taxed

What Is The Benefit Of Tax Deferred Growth Great American Insurance

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

What Are Tax Sheltered Investments Types Risks Benefits

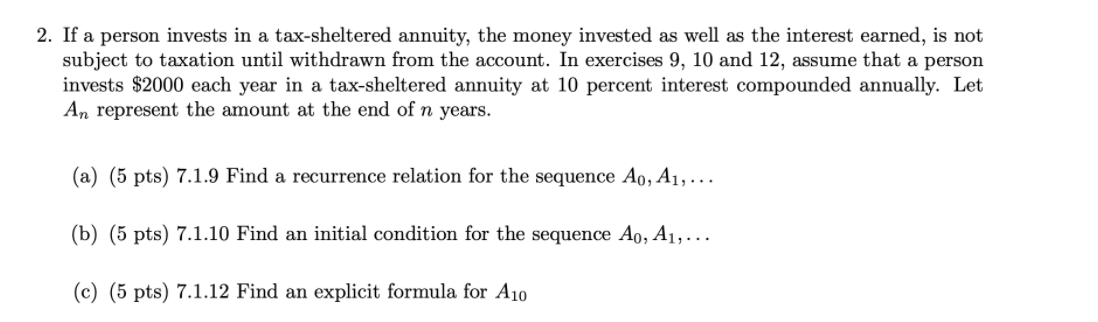

Solved 2 If A Person Invests In A Tax Sheltered Annuity Chegg Com

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Qualified Vs Non Qualified Annuities Taxation And Distribution

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

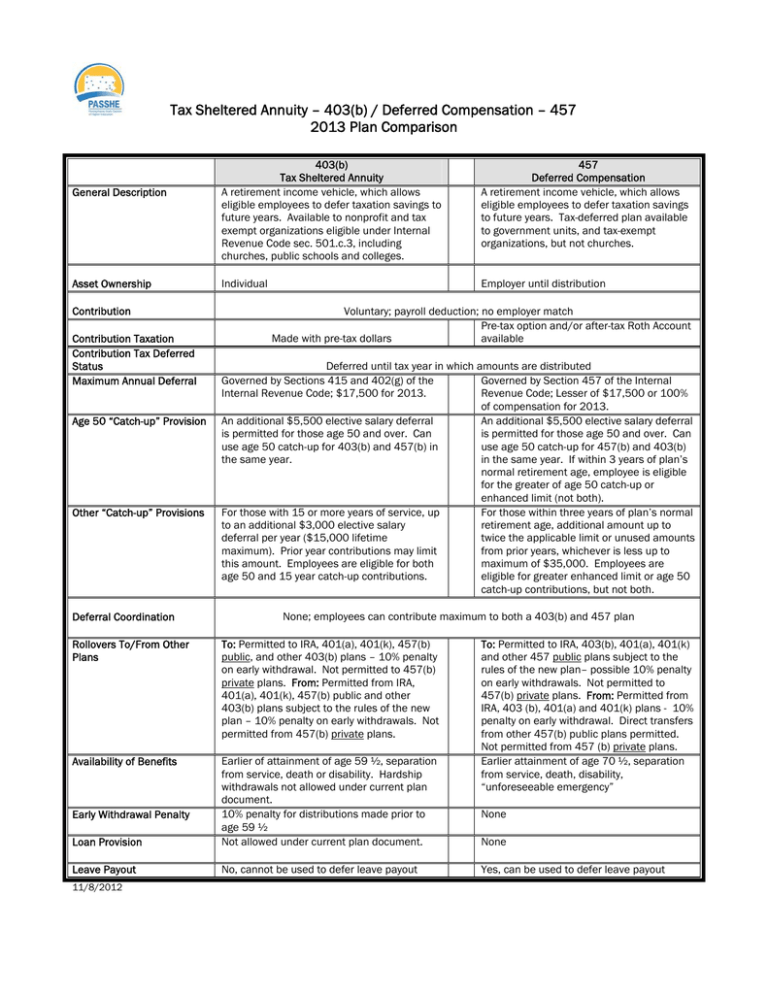

Tax Sheltered Annuity 403 B Deferred Compensation 457

How To Avoid Paying Taxes On Annuities Due

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Tax Sheltered Annuity Faqs Employee Benefits

Tax Deferred Annuity Definition Formula Examples With Calculations