flow through entity tax break

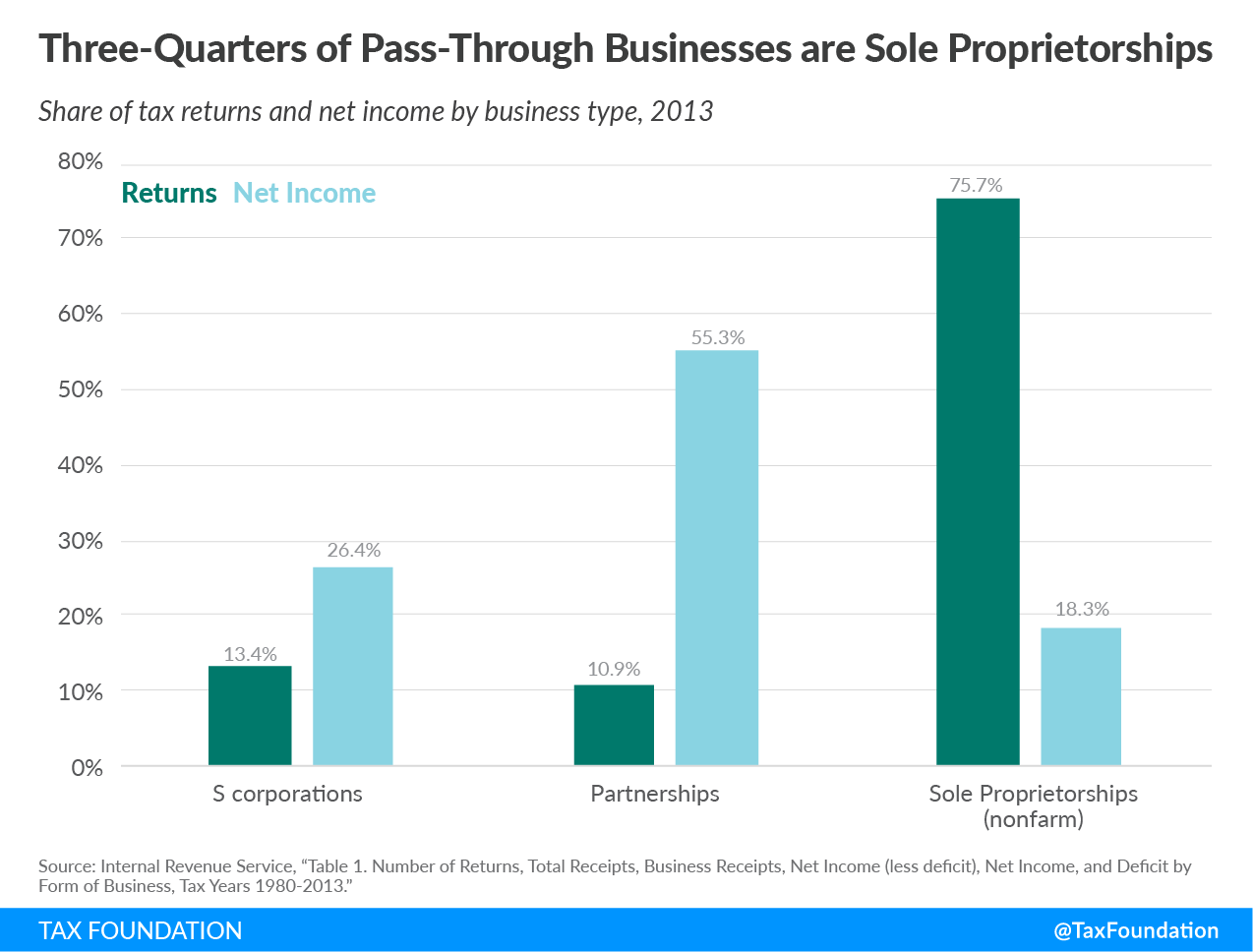

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

How A Pass Through Entity Tax Deduction Can Affect An M A Deal

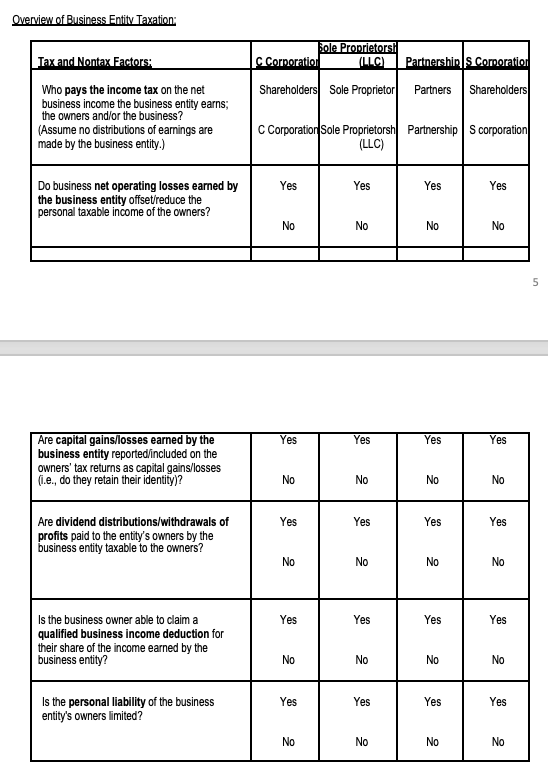

That is the income of the entity is treated as the income of the investors or owners.

. In the end the purpose of flow-through entities is the same as that of the other business. Instead their owners include their allocated shares of profits in. Pritzker signed Public Act 102-0658 into law.

Flow-through entities are used for several reasons including tax advantages. Assuming they do not receive multiple sources of. The biggest drawback to a flow-through entity is that individuals may face a higher tax burden.

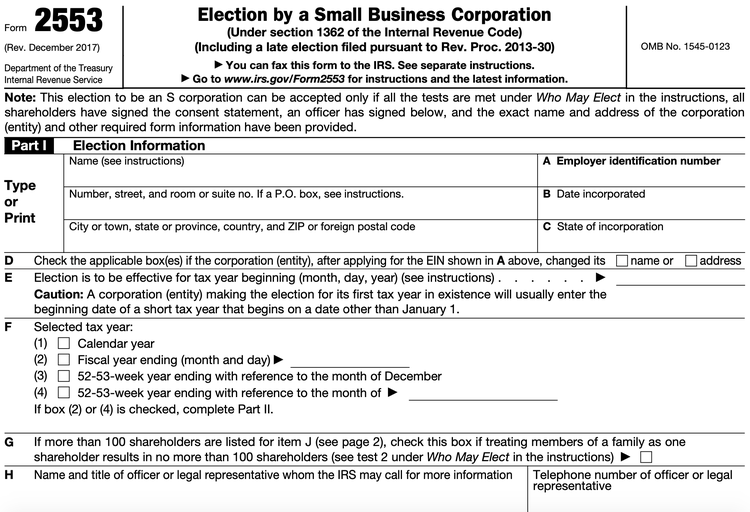

Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. When it comes to tax status the major business entities fall into one of two groups. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid.

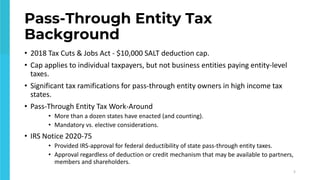

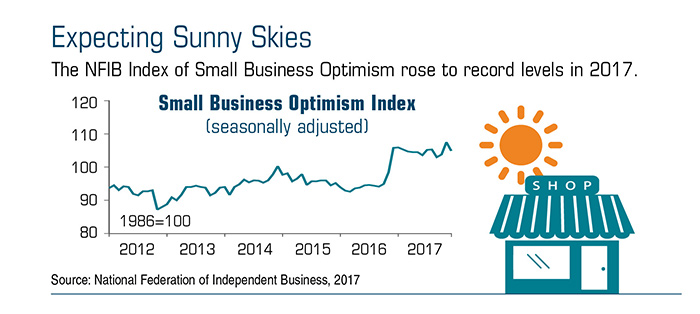

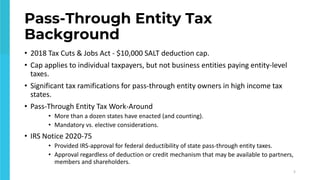

Regulations continue to change the thresholds and. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000. Take our quiz.

Flow-through or pass-through entities enable business owners to avoid double taxation. That dollar threshold is for single. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

The Act provides a significant tax break to owners of flow through entities S corporations. Federal income tax purposes or. However the late filing of 2021 FTE returns will be accepted as timely if.

On Friday August 27 2021 Illinois Governor JB. If youre exploring different ways to structure your business you may have come. Shareholdersmembers of such pass-through entities can then claim a credit on their Michigan individual income tax returns for their share of Michigan income taxes paid at.

Given that it is a partnership the income to each owner will be half of 80000 both will report an income of 40000 each. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. In this legal entity.

The benefits and tax obligations of operating flow-through entities and pass-through businesses are more complex than ever. What is a Flow-Through Entity. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors.

A flow-through entity is a legal entity where income flows through to investors or owners. Specifically the law disallowed pass-through owners from using business losses exceeding 250000 to offset non-business income. As a result only the individuals not the business are.

Sole-proprietorships LLCs S Corporations and partnerships. As the business owner even if you do not retain profit or pay yourself a dividend.

Corporate Tax In The United States Wikipedia

Pass Through Entity Tax Ptet Ce Credit Webinar Mycpe

Wisconsin Real Estate Magazine Tax Reform And Small Business Pass Through Entities

Tax Cuts And Jobs Act Impact On Pass Through Entities

Ohio Bill Allows Pass Through Entity Deduction

Qbi Deduction Provides Tax Break To Pass Through Entity Owners

The New York Pass Through Entity Tax Election Freed Maxick

Flow Through Entity Example Chantelle Larry Chegg Com

What Are The Benefits Of Pass Through Taxation Legalzoom

New Tax Breaks For Pass Through Entities Annuityadvantage

A Beginner S Guide To Pass Through Entities

Oregon Pass Through Entity Elective Tax Kernutt Stokes

High Net Worth Webinar Series Salt Thoughts Pass Through Entity Ta

What Is A Pass Through Business How Is It Taxed Tax Foundation

Pass Through Entity Tax Services Cherry Bekaert

Qbi Deduction Provides Tax Break To Pass Through Entity Owners Cpa Firm Tampa

Electing Pass Through Entity It 4738 Department Of Taxation

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

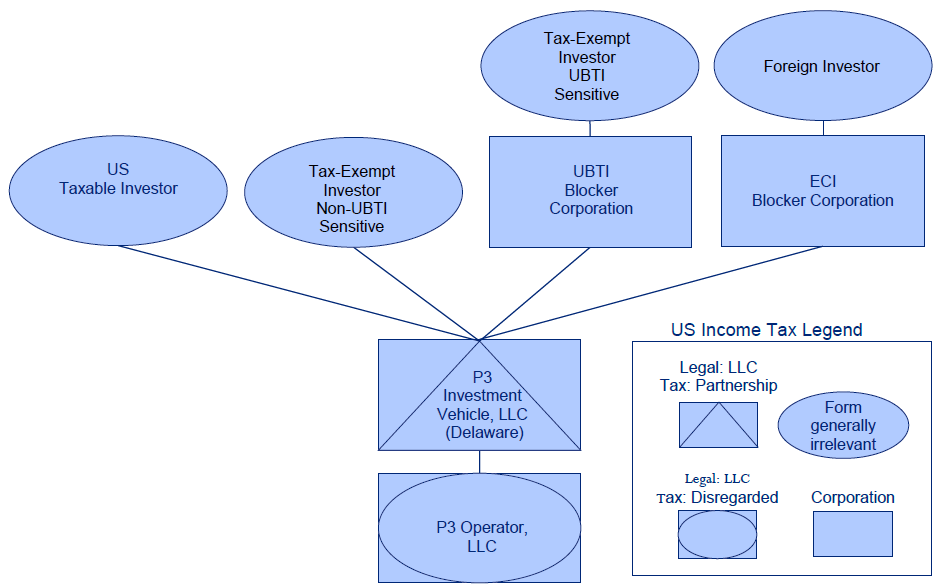

Fhwa Center For Innovative Finance Support P3 Toolkit Publications Reports And Discussion Papers